The Wagner Daily – February 25, 2022

Below is the full, archived issue of The Wagner Daily swing trading report (sent to members the night before the publication date).

Subscribe now for your access to the best stocks for swing trading, proven Morpheus stock trading strategy, and market timing model with a 20-year track record.

Just drop us a comment with any questions or comments–we’d love to hear from you!

The Wagner Daily – February 25, 2022

Proven swing trading strategy, top ETF & stock picks, and market timing model…since 2002

MTG Market Timing Model – SELL (day 1 of a new rally attempt)

Our timing model was designed to keep our trades in line with the prevailing market trend, not to call tops or catch bottoms in S&P 500 or Nasdaq Composite.

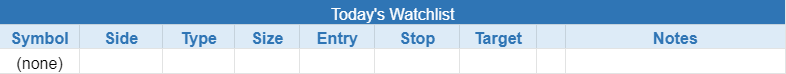

today’s watchlist (potential trade entries):

closed positions:

position notes:

- No trades triggered.

In last night’s report, we discussed the possibility of a gap-down reversal with US futures down more than 2% in after-hours trading. The combination of a big gap down after a two-week selloff below a major swing low and news of Russia attacking Ukraine, set the stage for a reversal, but certainly didn’t expect to see such a strong advance.

Thursday’s powerful reversal action is day one of a new rally attempt that was led by a big recovery in growth.

The Nasdaq Composite gained +3.3% on volume but closed an impressive 7% off the day’s low in what was almost a bullish engulfing day!

Growth ETFs ripped higher with $ARKK +7.8% and $IWP +4.3%. $ARKK closed 13% off the day’s low and with a bullish engulfing candle!

Whenever the market (ideally the Nasdaq) attempts to bottom out, we look for a few things:

- Higher lows, market should hold the low set on day one of the new rally attempt

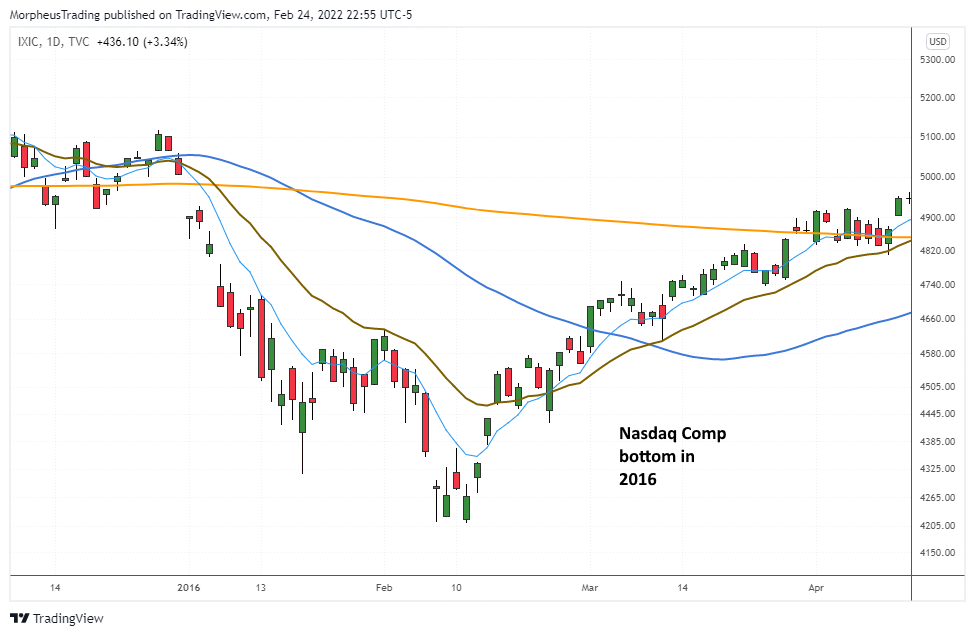

- Market reclaims 10-day SMA and eventually reclaims the 20-day EMA (within a few weeks)

- Follow through day (buy signal) prints on day 4 or later of a new rally attempt (may occur before or after the index reclaims the 20-day EMA)

- New leadership emerges to confirm the fresh new buy signal

Although the well-known follow-through day is still a valid buy signal, we do place more weight on the index reclaiming the 20-day EMA. Good things tend to happen once an index is above the 20-day EMA, so there is no need to rush to buy.

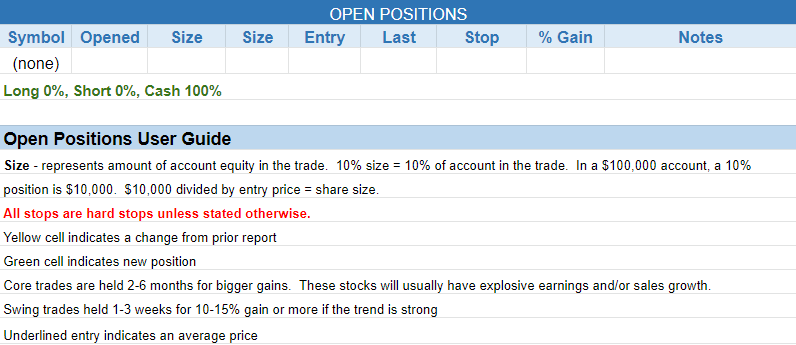

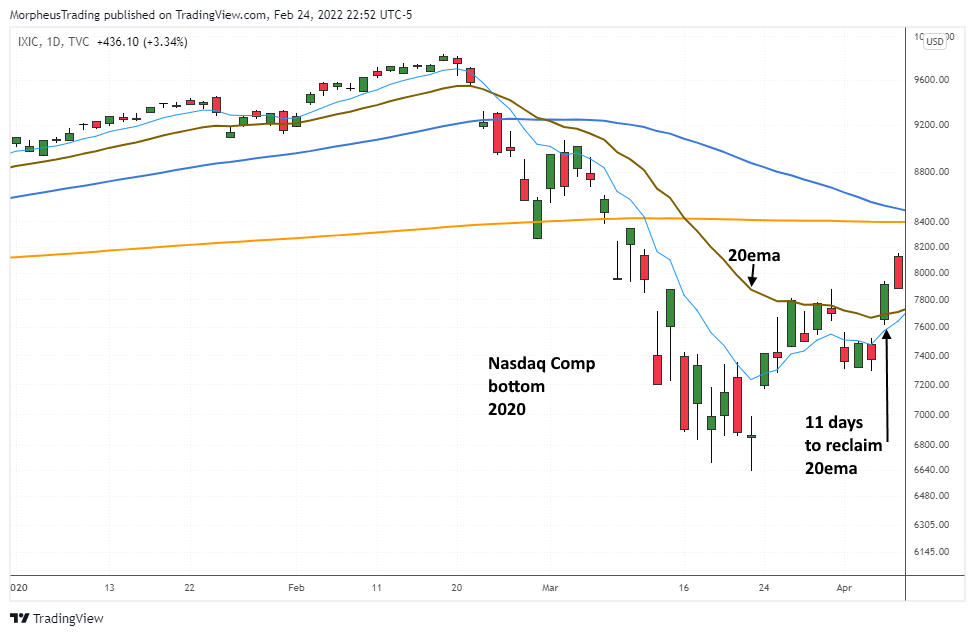

Below are a few examples of bottoming action on the daily chart of the Nasdaq since 2016. Not every bottom will play this way so these charts are just a guide.

In 2016, Nasdaq reclaimed the 20-day EMA in four sessions.

There are no new official setups for Friday as there are no low-risk entries (based on the daily chart) on either side of the market after Thursday’s action.

For those who prefer to be a bit more active with their trading, our living trading room on slack is where we discuss setups that develop on the fly, such as a gap-down reversal or a tight consolidation on the 15 or 60-minute charts.

Our short-term plan is to wait for some sort of low-risk buy point such as a tight-ranged inside day to form in faster-moving stocks that are bouncing from deeply oversold levels. If the rally attempt begins to show signs of sticking, then we’ll turn our focus to the more classic IBD/CANSLIM patterns such as the cup with handle, flat base, or double bottom.

Unofficial Setups – For experienced traders only, no guidance is given for these setups.

- Longs – none

- Shorts – none

See you in the chat room,

Rick

This list is a good starting point for monitoring the health of the market for those who have limited time.

https://morpheustrading.com/services/swing-trade-alerts

Start my Wagner Daily membership now to start receiving winning Morpheus stock trade signals, including a stock portfolio you can easily follow. The Wagner Daily PRO includes live swing trader room for daily, real-time trade ideas and powerful stock trading education.