The Wagner Daily – June 24, 2021

Below is the full, archived issue of The Wagner Daily swing trading report (sent to members the night before the publication date).

Subscribe now for your access to the best stocks for swing trading, proven Morpheus stock trading strategy, and market timing model with a 20-year track record.

Just drop us a comment with any questions or comments–we’d love to hear from you!

MTG Market Timing Model – buy mode due to strength in Nasdaq Composite (still above 20ema)

Our timing model was designed to keep our trades in line with the prevailing market trend, not to call tops or catch bottoms in S&P 500 or Nasdaq Composite.

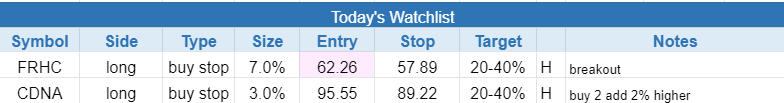

today’s watchlist (potential trade entries):

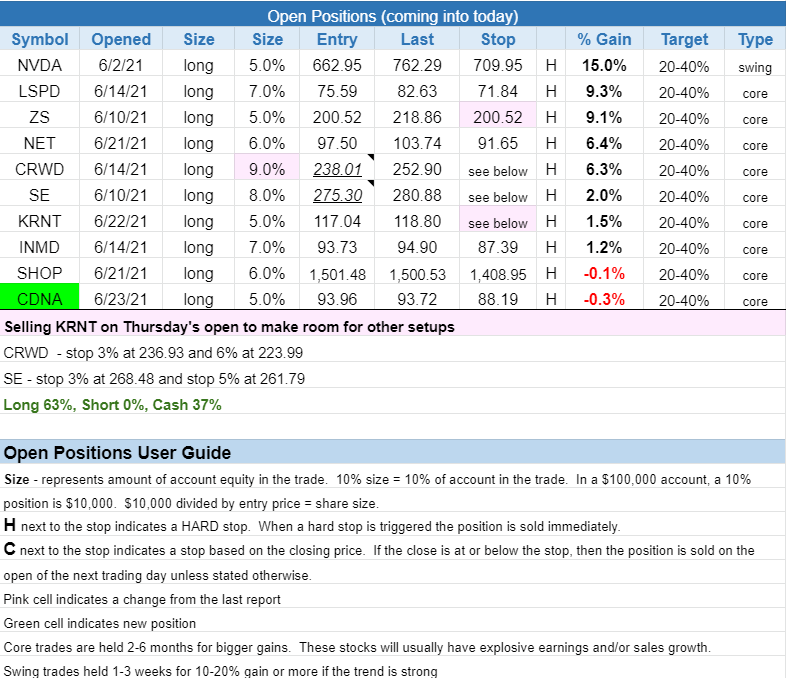

closed positions:

position notes:

- $CRWD add and $CDNA first buy stop triggered.

There isn’t much to report in terms of broad market action.

$CRWD buy limit order triggered and was added to the model portfolio. $CDNA 5% buy stop triggered as well. The 3% add is still live.

Note that we are selling $KRNT on Thursday’s open to make room for what we believe are better setups in $FRHC and $CDNA.

$SNAP triggered off the unofficial watchlist and broke out above the range high on a pick up in volume. The unofficial watchlist was created because we didn’t want to overwhelm subscribers with 5-10 official buy setups a day. With the current system, we may list 1-3 official setups and add another 2-3 to the unofficial list for more active traders.

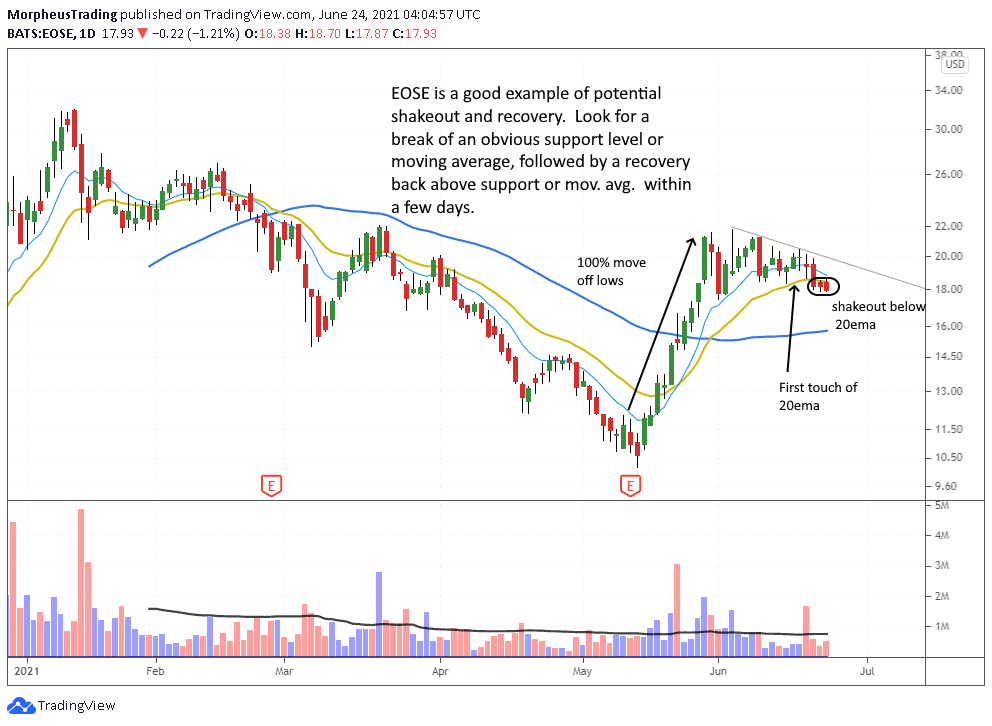

We often talk about bullish shakeouts in this report especially when we are discussing why we like a setup. A bullish shakeout is a short-term pullback that undercuts an obvious area of support, such as a swing low or key moving average for 1-3 days. The shakeout should be followed by an immediate recovery in price back above support within a few days.

The daily chart of $EOSE undercut support of the 20-day EMA a few days ago and has yet to recover back above. If $EOSE is a bullish shakeout, then it should bounce back soon as it’s already on day 3 of closing below the 20-day EMA.

$PATH is an unofficial buy setup that could be in play if the price takes 6/17 high and 10-day EMA. Note the support at $68, with four reversal candles since the big gap down reversal on 6/10. A break of the 6/10 low would invalidate the setup in the short term.

Unofficial Setups – For experienced traders only, no guidance is given for these setups.

$SOFI – buy at 21.83 (quick swing trade)

$ATOM – buy at 25.91 (quick swing trade)

Start my Wagner Daily membership now to start receiving winning Morpheus stock trade signals, including a stock portfolio you can easily follow. The Wagner Daily PRO includes live swing trader room for daily, real-time trade ideas and powerful stock trading education.