The Wagner Daily – May 13, 2022

Below is the full, archived issue of The Wagner Daily swing trading report (sent to members the night before the publication date).

Subscribe now for your access to the best stocks for swing trading, proven Morpheus stock trading strategy, and market timing model with a 20-year track record.

Just drop us a comment with any questions or comments–we’d love to hear from you!

MTG Market Timing Model – Sell

Our timing model was designed to keep our trades in line with the prevailing market trend, not to call tops or catch bottoms in S&P 500 or Nasdaq Composite.

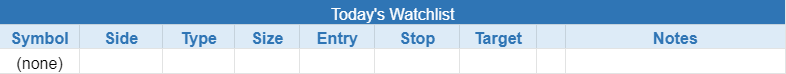

today’s watchlist (potential trade entries):

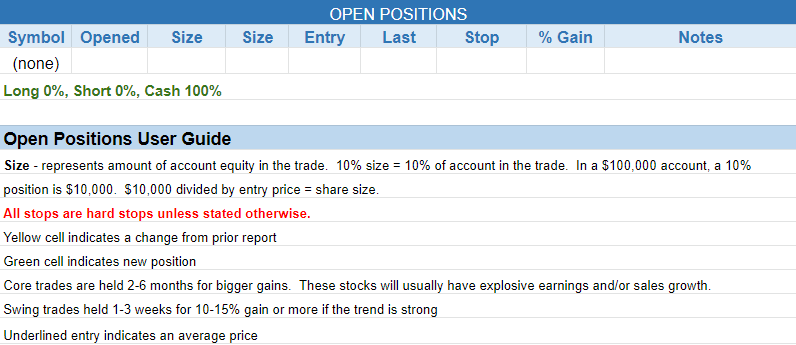

closed positions:

position notes:

- No trades triggered.

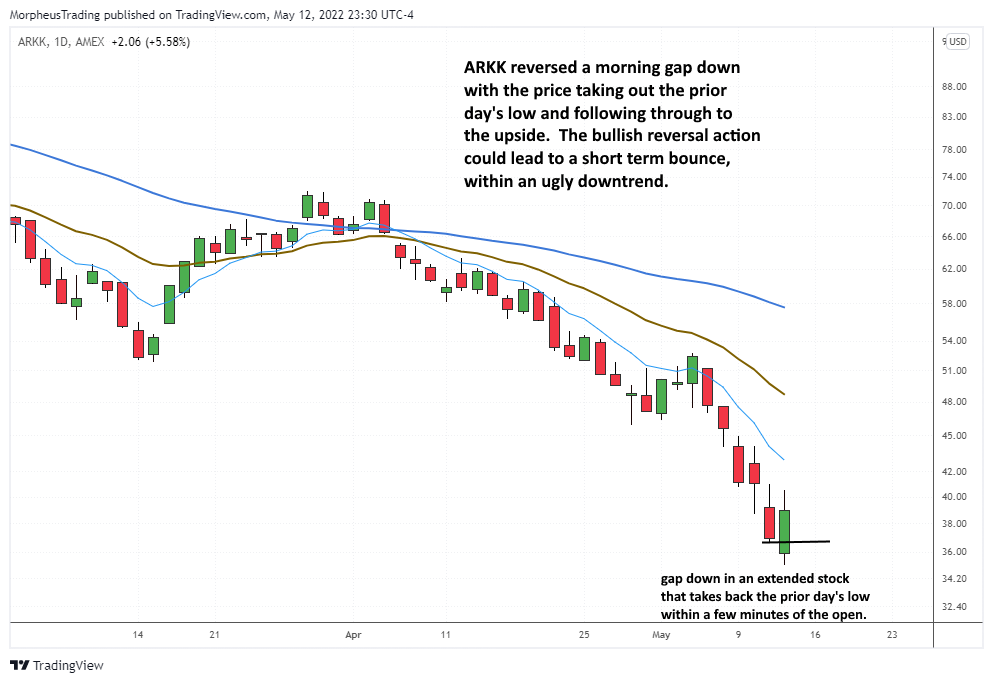

Although stocks failed to rally higher all session long, there was enough bullish action out there to suggest the current selloff may give way to a short-term bounce.

Nasdaq 100 ETF $QQQ closed off the highs of the day, but the long upper wick suggests the bears may be losing control. A higher open on Friday, that holds above Thursday’s close could spark a short-term bounce.

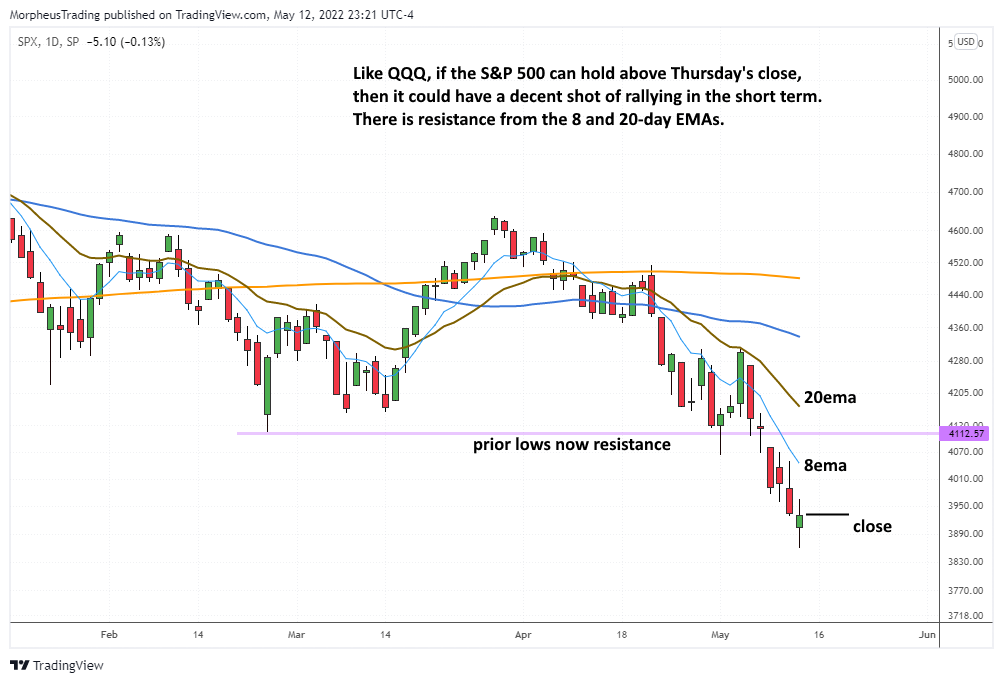

The S&P 500 has the same look as $QQQ and possibly due for a bounce.

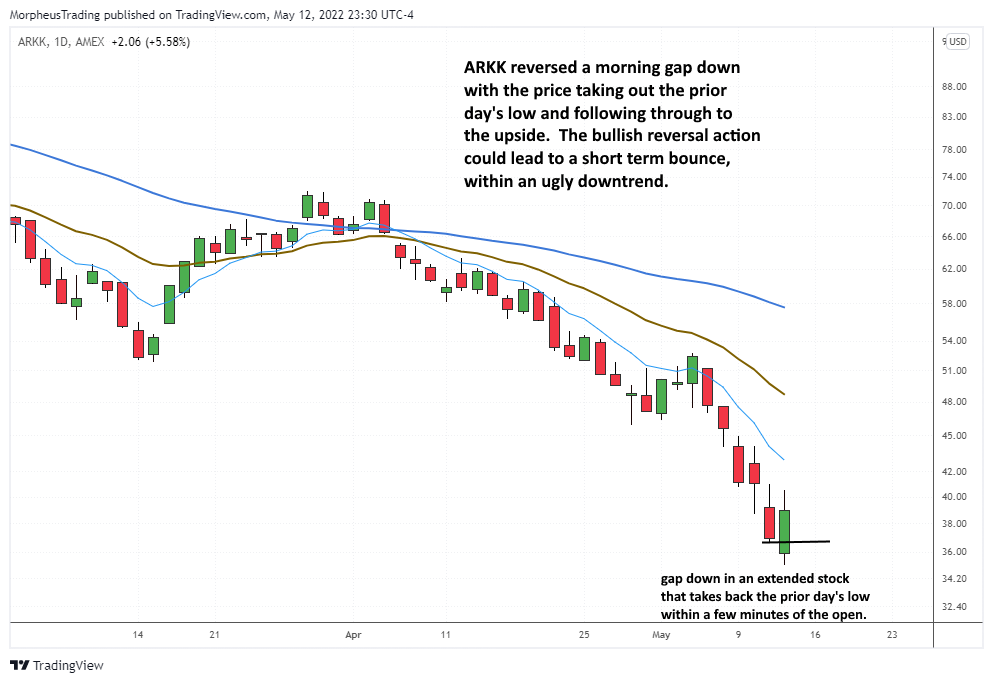

Growth ETF $ARKK had the best showing, with a gap down that reversed higher and just missed closing with a bullish engulfing candle. Look for $ARKK to push higher in the short-term as long as it doesn’t retrace too much of Thursday’s action.

Market leadership remains very thin, with most energy stocks running on fumes after a strong advance in the last 12-months.

Energy ETF $XLE is sitting just below 52-week highs but is not in play for us due to the volatility and multiple heavy volume down days within the base.

$MOS isn’t quite yet actionable for us but worth monitoring for bullish signs such as:

Given that the market remains in an ugly downtrend, we would view any bounce as a shorting opportunity until proven otherwise.

For us to entertain the long side, we’d have to see either a follow-through day on day 4 or later of a rally off the lows, or a major index reclaiming the 20-day EMA and holding. Until then, we are dealing with a short-term bounce in a bear market.

- Longs – just watching $CC $LLY $SJM $DG $DLTR $PPC

- Shorts – need a small bounce or few days of chop to produce new short setups

See you in the chat room,

Rick

This list is a good starting point for monitoring the health of the market for those who have limited time.

https://morpheustrading.com/services/swing-trade-alerts

Start my Wagner Daily membership now to start receiving winning Morpheus stock trade signals, including a stock portfolio you can easily follow. The Wagner Daily PRO includes live swing trader room for daily, real-time trade ideas and powerful stock trading education.