The Wagner Daily – September 20, 2022

Below is the full, archived issue of The Wagner Daily swing trading report (sent to members the night before the publication date).

Subscribe now for your access to the best stocks for swing trading, proven Morpheus stock trading strategy, and market timing model with a 20-year track record.

Just drop us a comment with any questions or comments–we’d love to hear from you!

MTG Market Timing Model – SELL (markets back below 20 & 50-day MAs

Our timing model was designed to keep our trades in line with the prevailing market trend, not to call tops or catch bottoms in S&P 500 or Nasdaq Composite.

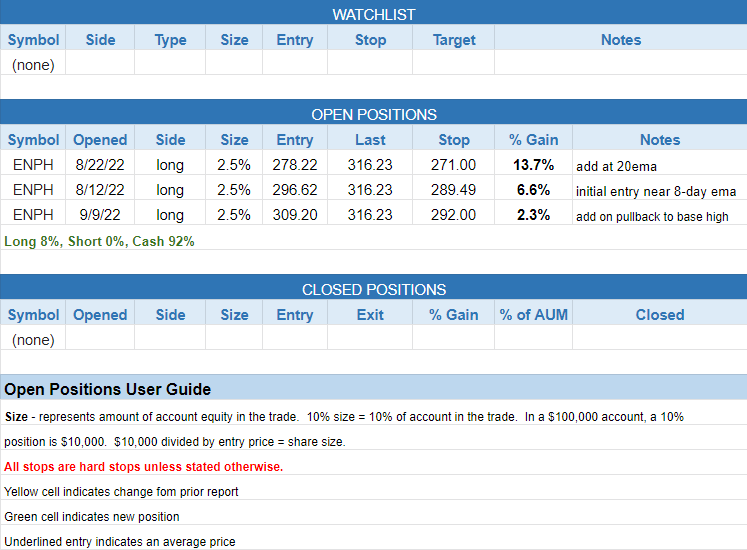

today’s watchlist along with open and closed positions:

- No trades.

Broad market averages closed with a bullish reversal candle for the second day in a row. The S&P 500 reclaimed the swing low and may bounce higher into Wednesday’s fed meeting, but has quite a bit of resistance in the 4,000 area from the declining 20-day EMA and uptrend line.

There are no new official setups for Tuesday ahead of Wednesday’s fed meeting.

If looking to establish new positions in this market, it’s best to buy after some sort of shakeout below a rising 20 or 50-day MA. Breakout entries should be avoided until there is a buy signal in place or proof that breakouts are working.

$ENPH has formed a tight trading range just below its all-time high. In a strong market, we’d look to add on a breakout but as mentioned above, breakout entries should be avoided.

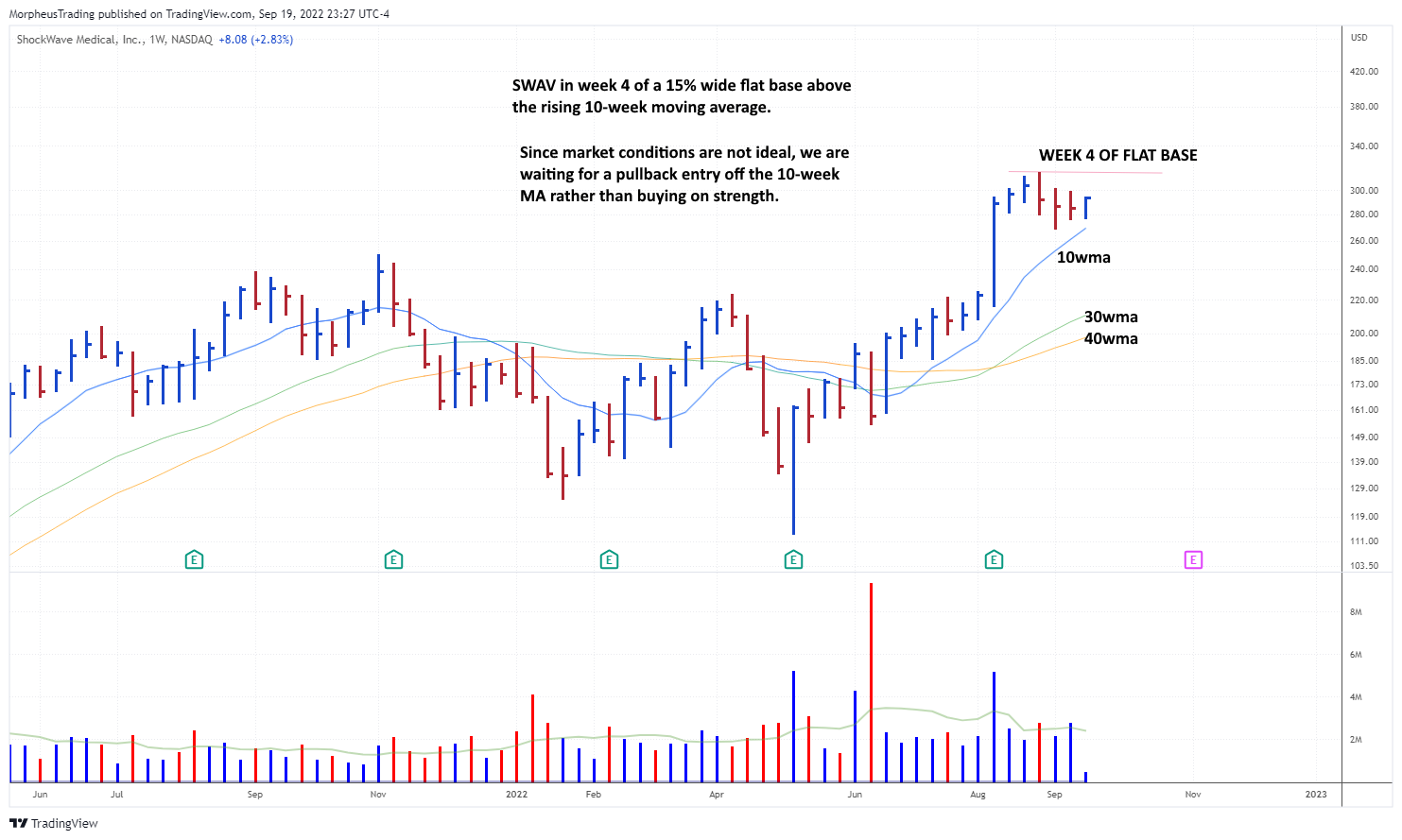

We continue to monitor $SWAV for a pullback entry at the rising 10-week MA, which is at $269.

$WOLF tried to breakout above range highs on Monday but failed to follow through. If $WOLF struggles to move higher, then we’d look to enter on weakness following a 2-3 day shakeout, if one develops.

Unofficial Setups –

- Longs – $SWAV on pullback to 10-week ma (around $269),

- Shorts – none

See you in the chat room,

Rick

Start my Wagner Daily membership now to start receiving winning Morpheus stock trade signals, including a stock portfolio you can easily follow. The Wagner Daily PRO includes live swing trader room for daily, real-time trade ideas and powerful stock trading education.

Add

Add