The Wagner Daily – February 28, 2022

Below is the full, archived issue of The Wagner Daily swing trading report (sent to members the night before the publication date).

Subscribe now for your access to the best stocks for swing trading, proven Morpheus stock trading strategy, and market timing model with a 20-year track record.

Just drop us a comment with any questions or comments–we’d love to hear from you!

MTG Market Timing Model – SELL (watching for a buy signal)

Our timing model was designed to keep our trades in line with the prevailing market trend, not to call tops or catch bottoms in S&P 500 or Nasdaq Composite.

today’s watchlist (potential trade entries):

closed positions:

position notes:

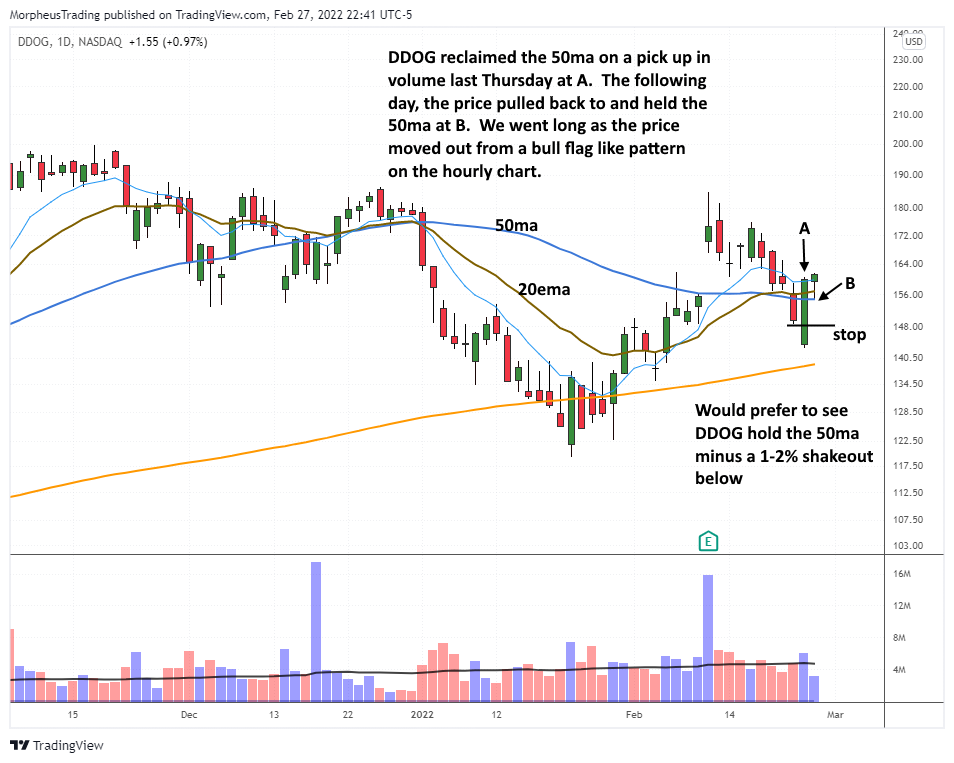

- Per intraday alert, bought a starter position in $DDOG near the 50-day MA.

Nasdsaq 100 futures are trading roughly -2.7% lower as of this writing and beneath the low of Friday’s primary session, but still above Friday’s pre-market low of 13,760.

Should the price remain weak overnight, then we could see gap-down-reversal type action Monday morning, where the price opens below the prior day’s low and recovers back above. Just one scenario of many that could play out.

Per intraday alert, $DDOG was added to the model portfolio Friday afternoon. Given the sharp reversal action in the market on Thursday, we dipped a toe in the water on the long side with a starter position off the 50-day MA.

$DDOG has a solid RS rating of 96 and is one of a few growth stocks trading within 20% of its 52-week high. Let’s see how it holds up on Monday.

Commodity stocks continue to dominate the top 40 industry groups but most are a bit too extended for a low-risk entry point. Some non-commodity names that are holding up well or breaking out are $MU, $AOSL, $LYV, $EXPE, $PANW, and $LNTH.

$MU is forming the handle portion of a cup with handle pattern and could be in play depending on Monday’s open. We will send an intraday alert if any action is taken.

The monthly chart is sitting just below the all-time high.

$LYV is also looking good near highs with an RS rating of 96 and a relative strength line breaking out to new highs ahead of price. No entry yet, just watching for now.

There are no new official setups for Monday, but as mentioned above we are closely monitoring $MU.

The commentary below is taken from last Friday’s report and will remain up this week.

What we look for in a market bottom:

- Higher lows, market should hold the low set on day one of the new rally attempt

- Market reclaims 10-day SMA and eventually reclaims the 20-day EMA (within a few weeks)

- Follow through day (buy signal) prints on day 4 or later of a new rally attempt (may occur before or after the index reclaims the 20-day EMA)

- New leadership emerges to confirm the fresh new buy signal. Breakouts are working.

Unofficial Setups – For experienced traders only, no guidance is given for these setups.

- Longs – watching $MU for an entry near the 50-day MA or over the short-term downtrend line. Potential entries off lows looking for a bounce (counter-trend pops): $RIVN $HOOD $PTON $RBLX $DASH

- Shorts – though $SNAP or any of the counter-trend longs that fail could be in play on short side (if market weakens)

See you in the chat room,

Rick

This list is a good starting point for monitoring the health of the market for those who have limited time.

https://morpheustrading.com/services/swing-trade-alerts

Start my Wagner Daily membership now to start receiving winning Morpheus stock trade signals, including a stock portfolio you can easily follow. The Wagner Daily PRO includes live swing trader room for daily, real-time trade ideas and powerful stock trading education.