The Wagner Daily – May 11, 2021

Below is the full, archived issue of The Wagner Daily swing trading report (sent to members the night before the publication date).

Subscribe now for your access to the best stocks for swing trading, proven Morpheus stock trading strategy, and market timing model with a 20-year track record.

Just drop us a comment with any questions or comments–we’d love to hear from you!

MTG Timing Model – S&P 500 buy, Nasdaq Composite sell

Our timing model was designed to keep our trades in line with the prevailing market trend, not to call tops or catch bottoms in S&P 500 or Nasdaq Composite.

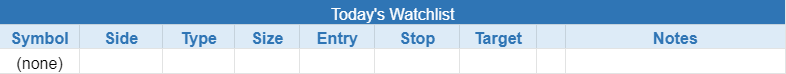

today’s watchlist (potential trade entries):

closed positions:

position notes:

- No trades triggered.

An ugly reversal day in the S&P 500 and in leading stocks could lead to further weakness if the 20-day EMA does not hold. If the S&P is in a rising channel with tight swings, then low-risk buy points off support should work better than buying breakouts (in individual names).

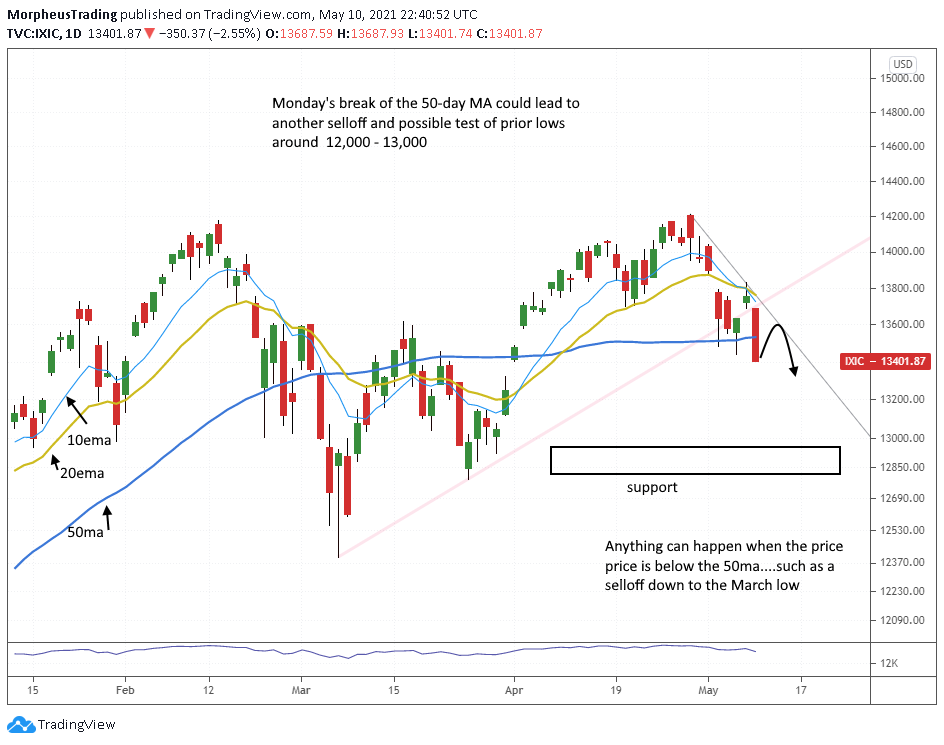

The Nasdaq’s break of the 50-day MA on volume is a concern, as price action can turn ugly in a hurry when below the 50ma. Anything can happen price-action-wise, but the odds have increased for further weakness.

Our main concern right now is the S&P 500 and current leadership. Where will money flow if $XLF, $XLB, $IYT, and $NAIL are too extended and in need of 2-3 weeks of rest and the S&P 500 loses the 20-day EMA? Anything can happen, but we doubt back into growth, as there are no clear signs of industry group strength there.

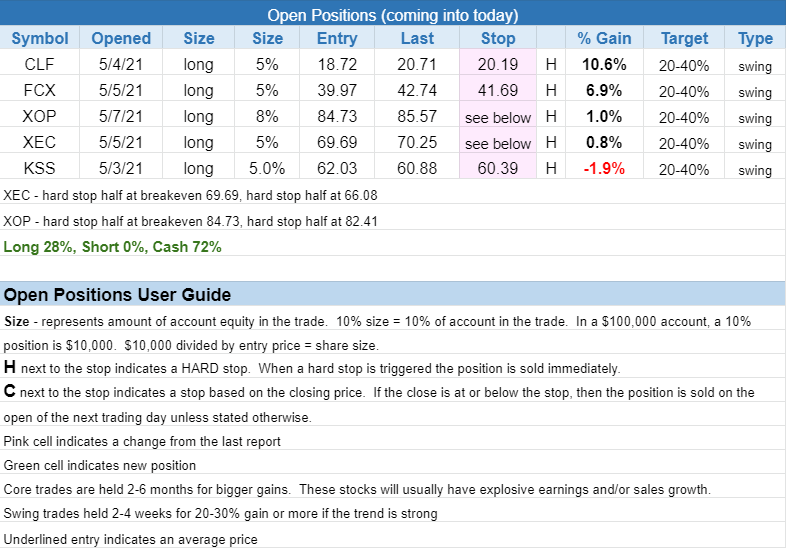

Given the sharp reversal action in $CLF and $FCX, we are forced to play defense and preserve some gains. Not ideal, but we are not in an A+ rally with growth stocks leading the way.

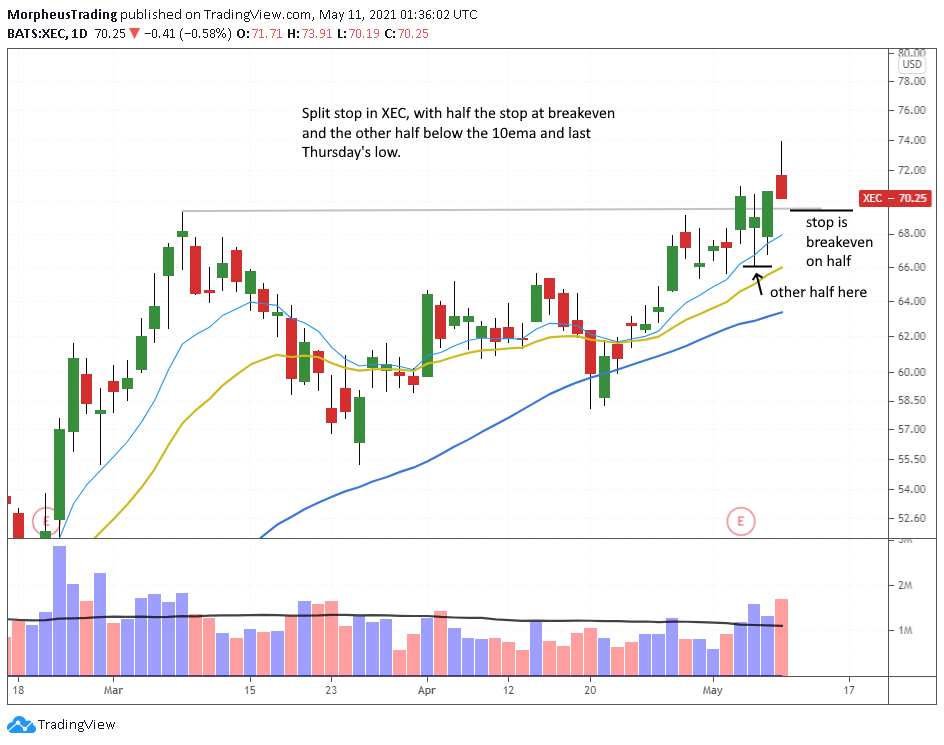

Note that we have break-even stops on half the position in energy trades $XOP and $XEC. The stops on the remaining half positions are beneath the 2-day low.

Unofficial Setups – For experienced traders only, no guidance is given for these setups.

- None – After Monday’s reversal action, there isn’t much out there in terms of actionable setups.

Start my Wagner Daily membership now to start receiving winning Morpheus stock trade signals, including a stock portfolio you can easily follow. The Wagner Daily PRO includes live swing trader room for daily, real-time trade ideas and powerful stock trading education.