The Wagner Daily – May 12, 2021

Below is the full, archived issue of The Wagner Daily swing trading report (sent to members the night before the publication date).

Subscribe now for your access to the best stocks for swing trading, proven Morpheus stock trading strategy, and market timing model with a 20-year track record.

Just drop us a comment with any questions or comments–we’d love to hear from you!

S&P 500 buy, Nasdaq Composite buy

Our timing model was designed to keep our trades in line with the prevailing market trend, not to call tops or catch bottoms in S&P 500 or Nasdaq Composite.

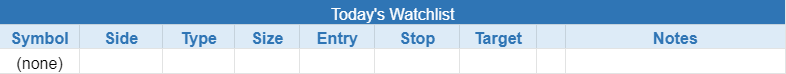

today’s watchlist (potential trade entries):

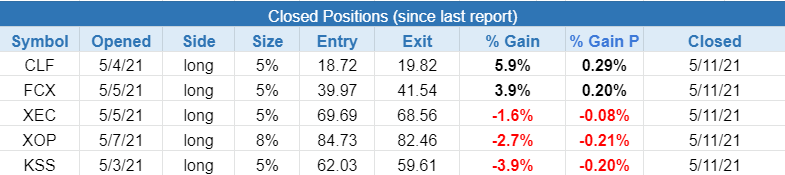

closed positions:

position notes:

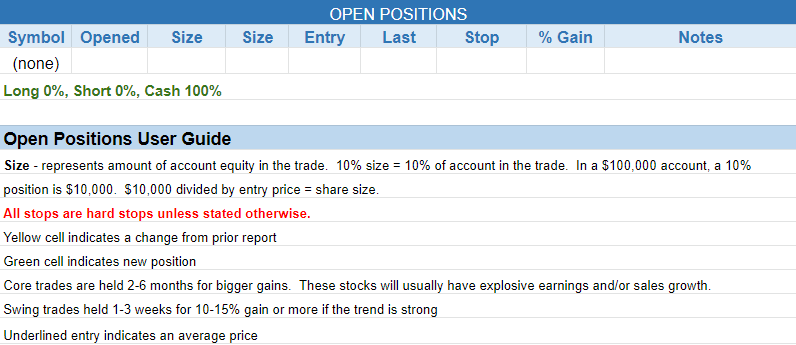

- Back in cash.

Broad market averages gapped significantly lower on Tuesday but did manage to stage a solid comeback with a close in the top 20% of the day’s range. The S&P 500 closed below the 20-day EMA for the first time in a while and could potentially trigger a sell signal with a break of Tuesday’s low.

The Nasdaq closed near the highs of the session but had to rally just over 2% from the open to get there. Any bounce may have a tough time sticking due to all the resistance around the 50-day MA.

The Nasdaq Composite weekly chart may be tightening if the 13,000 area holds up.

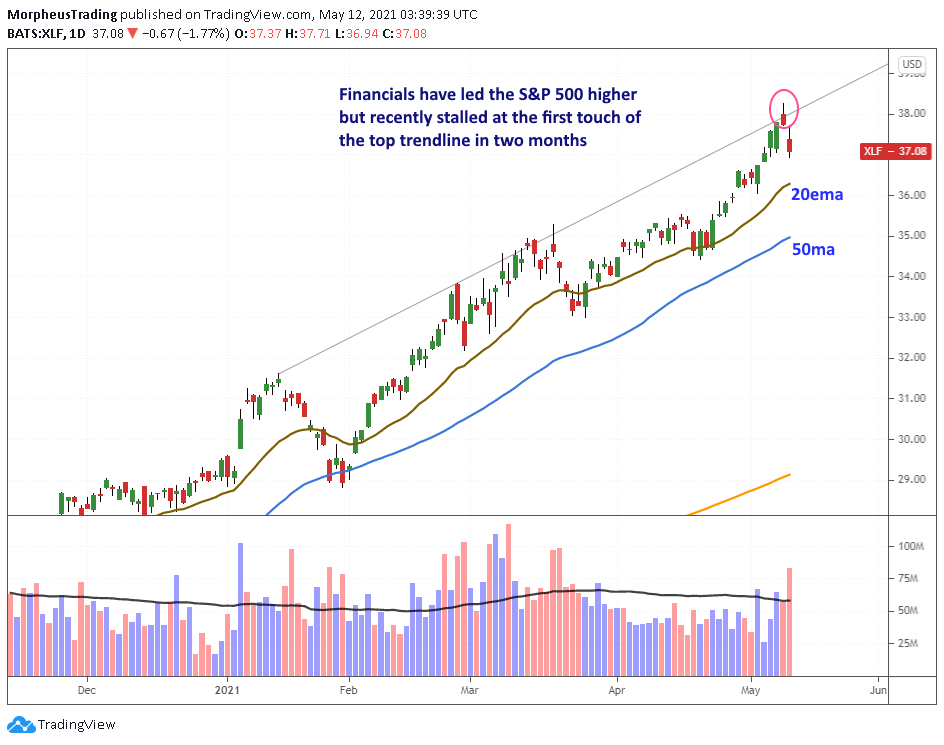

S&P 500 may be losing some leadership with financial ETF $XLF stalling at the top trendline. The chart may need a few weeks of rest to digest the last advance.

$HOME’s big volume breakaway gap up and tight range on declining volume is a bullish look. This is not an official setup but could be in play unofficially over Monday’s high with a stop beneath $36.

$RBLX is not in play for us right now but we are monitoring the action to see how it handles resistance in the $77-78 area.

The model portfolio stopped out of all open positions on Tuesday and is now 100% in cash. $FCX and $CLF sell stops triggered for small gains which offset recent losses.

There are no new setups for Wednesday as we wait for new patterns to emerge.

Unofficial Setups – For experienced traders only, no guidance is given for these setups.

- $HOME – buy at 36.84

- watching – $TMST $SUM $GVA $MDP $SGMS $TS $MDP $COIN $UPST $RBLX

Start my Wagner Daily membership now to start receiving winning Morpheus stock trade signals, including a stock portfolio you can easily follow. The Wagner Daily PRO includes live swing trader room for daily, real-time trade ideas and powerful stock trading education.