Morpheus Crypto Report – April 25, 2022

Below is the full, archived version of Morpheus Crypto Report that was sent to subscribers on April 18, 2022.

If you enjoy what you see, simply subscribe to receive real-time access to your live crypto trader room, crypto trading analysis, crypto signals, and crypto portfolio.

Please drop us any questions or comments at the bottom of the post–we’d love to hear from you!

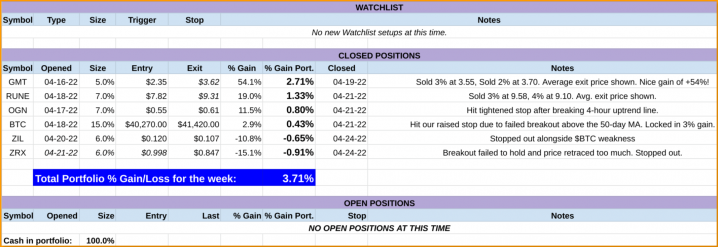

Crypto Portfolio

(tracks and updates all crypto signals sent to members)

New crypto signals sent to members since the previous week are in yellow above.

Bullish Bitcoin reversal at key support level

In our previous report, we showed you that Bitcoin ($BTC) formed a bullish reversal candle after undercutting support and rallying back above “psychological resistance” at the 40,000 level on April 18.

That bullish reversal day triggered a new, short-term buy signal, and prompted us to buy $BTC in the Morpheus Crypto portfolio that day.

However, we also warned that $BTC could still pullback after rallying into key resistance of its 50-day moving average around 42,100–and that’s exactly what happened!

$BTC initially blasted through its 50-day MA on April 21, but failed to hold the breakout for more than a few hours before selling pressure caused the price to slide lower.

The failed breakout attempt at the 50-day MA attracted further selling, which weighed heavily on Bitcoin and most altcoins for four more days.

Bearish price action began intensifying on April 25, initially causing $BTC to plunge below the low of its April 18 reversal day.

However, the bulls stepped in, reversed the bearish momentum, and pushed Bitcoin back above that pivotal 40,000 level again.

As such, $BTC formed another bullish reversal day on April 25; exactly one week after the formation of the previous one.

The April 25 reversal day, confirmed by higher volume, technically shifts the short-term balance of power back to the bulls.

Nevertheless, a lot of overhead supply has been created in the wake of the recent sell-off sparked by the bearish reversal at the 50-day MA.

It’s also notable that Bitcoin continues loosely moving in sync with the US stock market–and that’s not good considering the current technical state of US stocks.

It’s unlikely the $BTC reversal bar would have formed on April 25 if the Nasdaq would have failed to bounce that day.

Furthermore, the April 25 bullish reversal day may be unable to follow through IF recent, heavy selling pressure in the Nasdaq remains in the coming days.

As such, we remain quite cautious regarding new potential trade entries at this time.

“Hit and Run” swing trading yields another week of solid gains

With Bitcoin showing choppy, indecisive price action near pivotal support and resistance levels lately, we have been focused on shorter time frames for most of our trade entries.

In a strong bull market, we would aim for massive gains by letting the profits run with the uptrend.

However, trying to squeeze too much alpha from a trade in the current environment can easily lead to a winning trade turning into a loser.

Our “hit and run” trading time frame paid off last week, as we promptly locked in sizeable winning trades before $BTC fell apart on the failed test of the 50-day MA.

For the week, your Morpheus Crypto Portfolio locked in a net portfolio gain of +3.7%.

STEPN ($GMT), which initially entered our watchlist entry three weeks ago, was our biggest winner last week.

We bagged a sweet price gain of +54% through holding $GMT for just 3 days!

The original buy setup is shown below, along with our actual portfolio entry and exit prices we alerted you to:

Watchlist

Because of mixed signals and recent indecision in $BTC, our overall short-term market bias is currently neutral to slightly bullish.

As such, we are satisfied that the Morpheus Crypto Portfolio is currently 100% cash; it gives us the ability to easily “stick and move” as necessary.

Nevertheless, we continue scanning hundreds of charts to look for the best crypto swing trade setups if/when market conditions improve.

Below are the symbols of a few altcoins with high relative strength that we are stalking for potential buy entry (as long as Bitcoin holds up):

- $KNC – Massive relative strength and steady uptrend on daily chart. Looking for low-risk pullback entry.

- $DOGE – Although we still do not like the fundamentals of $DOGE, it has broken out on massive volume due to news of Elon Musk buying Twitter (!!). Big volume doesn’t lie. Watching for potential pullback to its 10-day MA.

- $NEAR – Strong fundamentals and high relative strength, with a recent pullback to the 50-day MA.

- $MTRG – High relative strength and steady daily uptrend. Looking for a pullback entry.

- $MTX – Big volume breakout on daily chart. Pulled back and now entering consolidation.

- $HBB – Massive volume and breakout two weeks ago. Now on a pullback. Looking for low-risk entry.

As always, we will promptly send you a trade alert with details if/when we enter any of these trades in your Morpheus Crypto portfolio this week.

SIGN UP NOW to start receiving your winning Morpheus crypto trade signals, including a crypto portfolio you can easily follow. Morpheus Crypto PRO includes live crypto trader room for daily, real-time trade ideas and powerful crypto trading education.