The Wagner Daily – July 16, 2021

Below is the full, archived issue of The Wagner Daily swing trading report (sent to members the night before the publication date).

Subscribe now for your access to the best stocks for swing trading, proven Morpheus stock trading strategy, and market timing model with a 20-year track record.

Just drop us a comment with any questions or comments–we’d love to hear from you!

MTG Market Timing Model – buy mode due to strength in Nasdaq Composite (still above 20ema)

Our timing model was designed to keep our trades in line with the prevailing market trend, not to call tops or catch bottoms in S&P 500 or Nasdaq Composite.

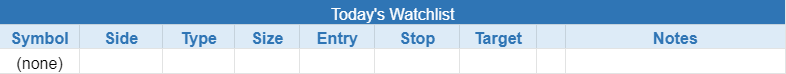

today’s watchlist (potential trade entries):

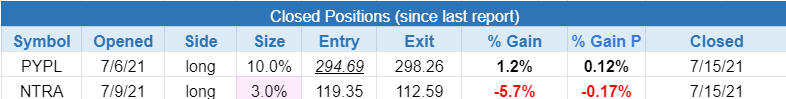

closed positions:

position notes:

- Stopped out of $PYPL and $NTRA

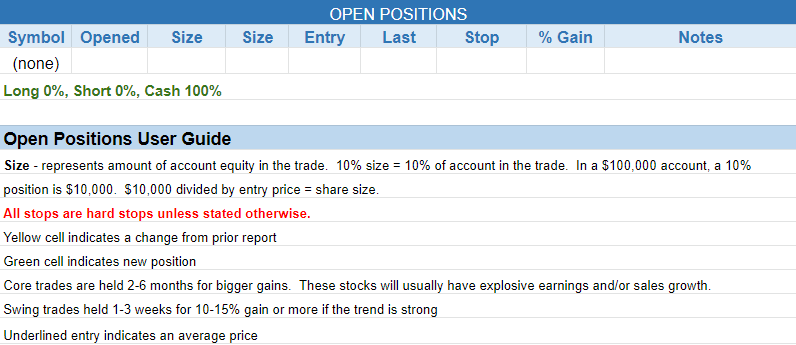

With $PYPL and $NTRA triggering stops, the model portfolio is now 100% in cash. There are no new official setups for Friday’s session as our nightly scans did not turn up much in the way of low-risk buy points. This shouldn’t be much of a surprise given the recent weakness in $IWP, $FFTY, $IWM, and the Nasdaq Composite.

Nasdaq Composite remains in an uptrend as long as it continues to hold the 20-day EMA on a closing basis.

The uptrend in $AAPL is losing steam based on the last two days of price and volume action. A break of Thursday’s low could spark some profit-taking and put pressure on the Nasdaq.

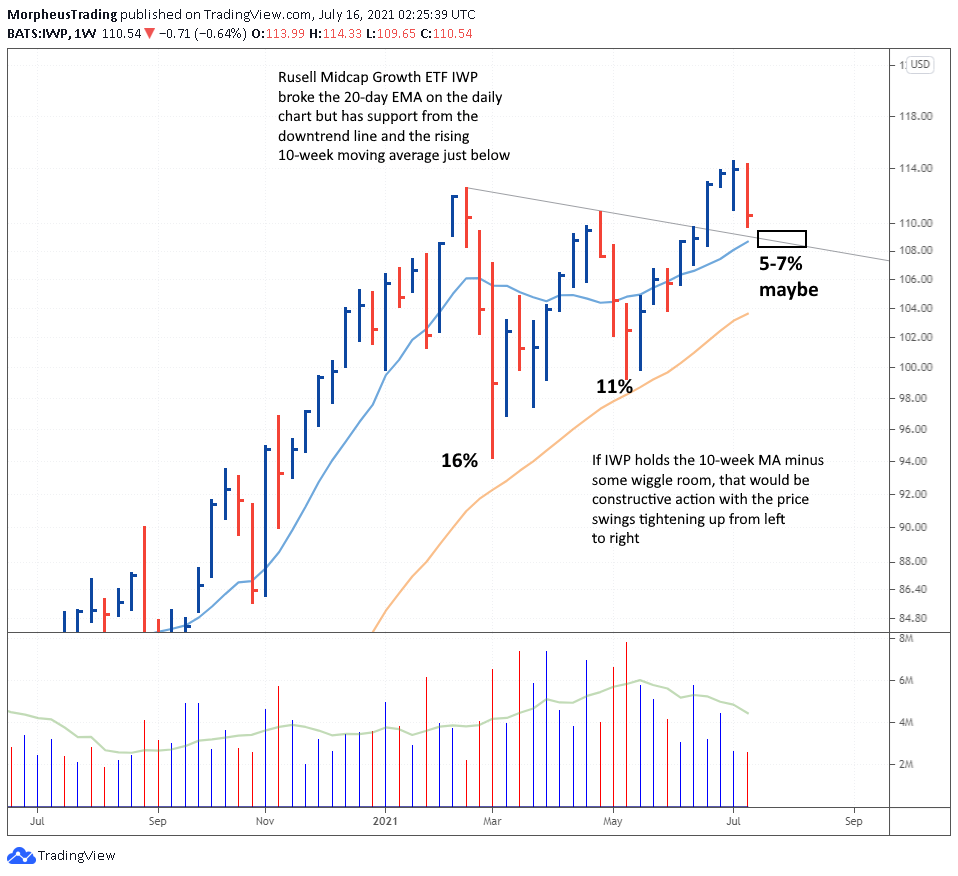

Midcap growth ETF $IWP closed below the 20-day EMA and triggered a sell signal on Thursday with a break of the prior day’s low. On the weekly chart, there is support from the downtrend line and rising 10-week moving average just below. Overall, the weekly pattern is constructive with the price swings tightening up from left to right on the chart.

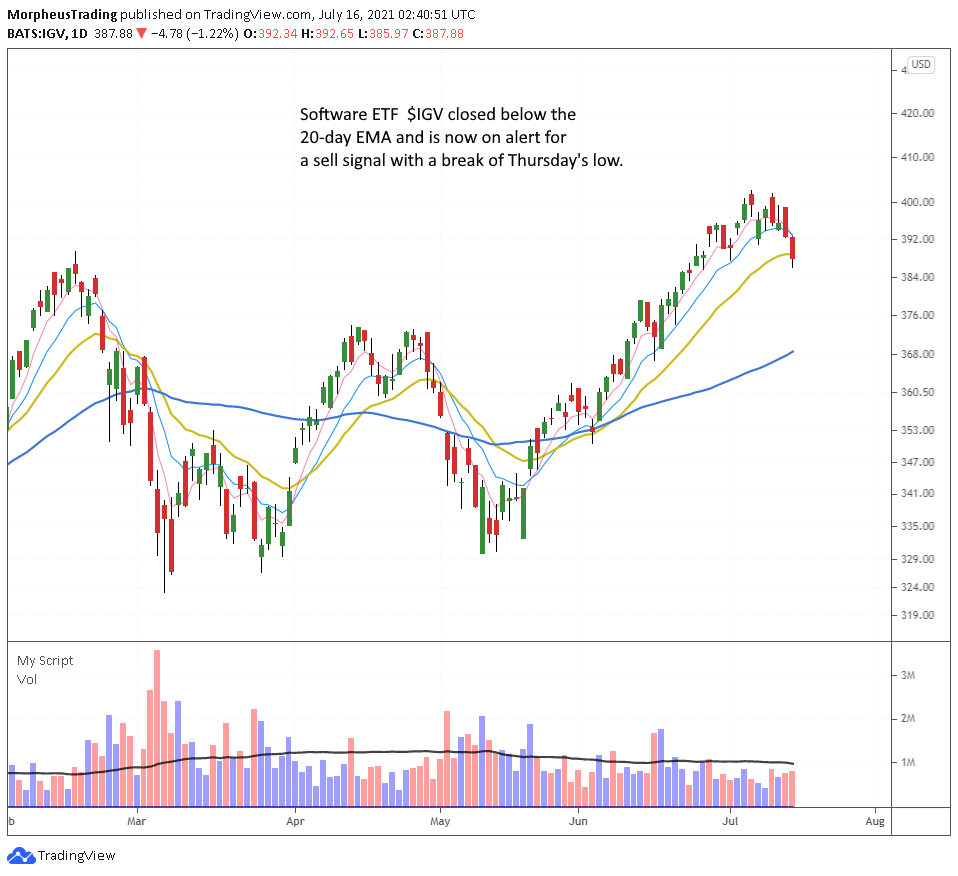

Software ETF $IGV is in danger of triggering a sell signal.

$NVDA’s break of the 20-day EMA on volume suggests the chart may need a few weeks of lower to sideways action to digest the last wave up. If so, then we’d look for a 10%-15% deep flat base to develop during the next few weeks above the rising 10ma on the weekly chart.

Unofficial Setups – For experienced traders only, no guidance is given for these setups.

- none

Start my Wagner Daily membership now to start receiving winning Morpheus stock trade signals, including a stock portfolio you can easily follow. The Wagner Daily PRO includes live swing trader room for daily, real-time trade ideas and powerful stock trading education.