The Wagner Daily – March 7, 2022

Below is the full, archived issue of The Wagner Daily swing trading report (sent to members the night before the publication date).

Subscribe now for your access to the best stocks for swing trading, proven Morpheus stock trading strategy, and market timing model with a 20-year track record.

Just drop us a comment with any questions or comments–we’d love to hear from you!

MTG Market Timing Model – SELL

Our timing model was designed to keep our trades in line with the prevailing market trend, not to call tops or catch bottoms in S&P 500 or Nasdaq Composite.

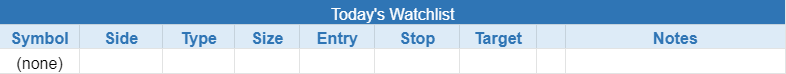

today’s watchlist (potential trade entries):

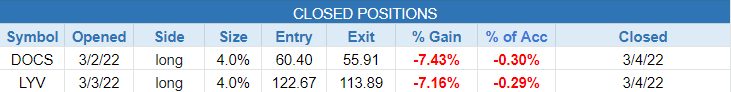

closed positions:

position notes:

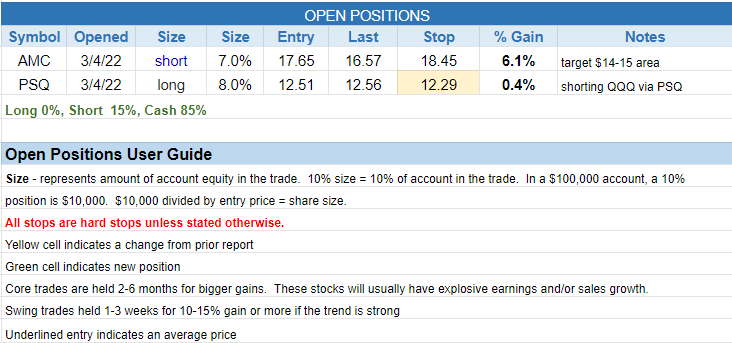

- Stopped out of $LYV and $DOCS.

- Per intraday alert, sold short $AMC and $QQQ through the inverse ETF $PSQ.

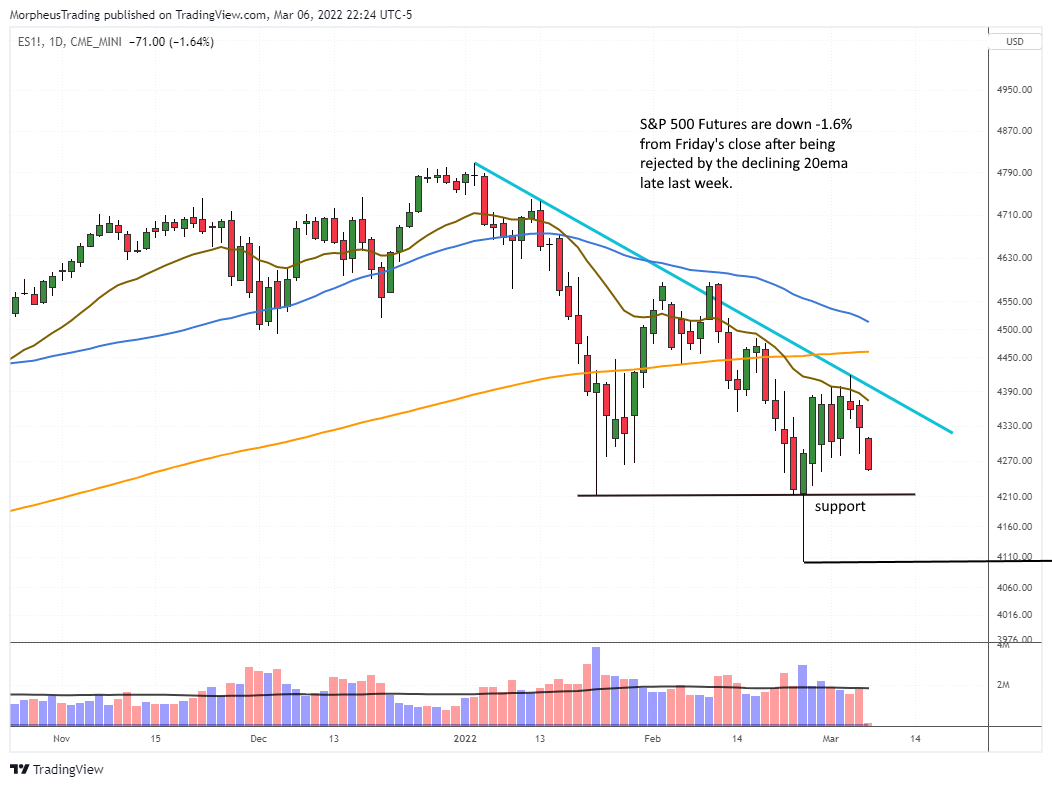

Nasdaq 100 futures is following through on Friday’s weakness and down -2% as of this writing.

The daily chart is now back below the January low at 13,700 and may be headed to the prior low IF the 13,400 area does not hold.

S&P 500 futures is -1.6% off Friday’s close but still above the January low.

Continues to struggle with the declining 20-day EMA.

e

e

Per intraday alert, we established two short positions last Friday in $PSQ and $AMC. $PSQ is an inverse ETF that allows us to short $QQQ by going long.

The target for the $AMC trade and the reason for the entry are detailed on the chart below.

The model portfolio is 15% invested on the short side after stopping out of long positions in $LYV and $DOCS.

Since the US markets are significantly lower in after-hours trading, there are no new official setups for Monday. Stay tuned for intraday alerts.

Several short setups from the unofficial short watchlist triggered last week and have worked out well.

Below are a few of the short setups showing the same type of look, bouncing into a declining 8-10 day moving average in a weak market.

On the long side, most oil names are too extended to be in play. Defense stock $RTX has pulled back off the highs after a strong breakout and is potentially in play for a swing trade over last Friday’s high or on a gap-down reversal entry if Monday’s open is below Friday’s low. This is not an official setup.

Keys to market turning bullish:

- Buy signal in the timing model through a FTD or reclaim of 21-day EMA

- Stocks begin to breakout on volume and hold… indexes hold the 21-day EMA

- The number of stocks making new 52-week highs vs 52-week lows enters into positive territory

- After the first wave of breakouts, new setups emerge

Unofficial Setups – For experienced traders only, no guidance is given for these setups.

- Longs – $KSS $RTX

- Shorts – $DKNG $GDRX $CLX (below prior day’s low unless there is a big gap down)

See you in the chat room,

Rick

This list is a good starting point for monitoring the health of the market for those who have limited time.

https://morpheustrading.com/services/swing-trade-alerts

Start my Wagner Daily membership now to start receiving winning Morpheus stock trade signals, including a stock portfolio you can easily follow. The Wagner Daily PRO includes live swing trader room for daily, real-time trade ideas and powerful stock trading education.