The Wagner Daily – July 15, 2021

Below is the full, archived issue of The Wagner Daily swing trading report (sent to members the night before the publication date).

Subscribe now for your access to the best stocks for swing trading, proven Morpheus stock trading strategy, and market timing model with a 20-year track record.

Just drop us a comment with any questions or comments–we’d love to hear from you!

MTG Market Timing Model – buy mode due to strength in Nasdaq Composite (still above 20ema)

Our timing model was designed to keep our trades in line with the prevailing market trend, not to call tops or catch bottoms in S&P 500 or Nasdaq Composite.

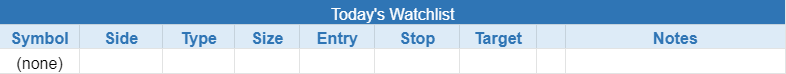

today’s watchlist (potential trade entries):

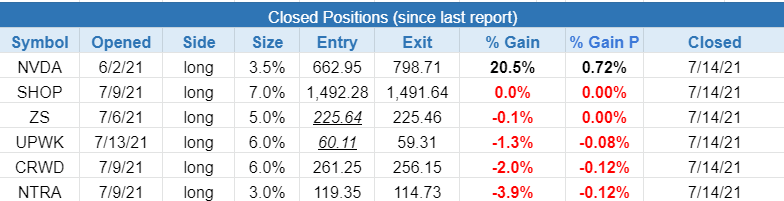

closed positions:

position notes:

- No trades triggered.

Although the Nasdaq Composite, Nasdaq 100, and S&P 500 remain near highs, the action under the hood is cause for concern as there were 41 stocks down 3% or more on a list of roughly 120 stocks. Leadership has narrowed to just a few big cap tech stocks pushing higher, which isn’t a positive sign for the current rally.

Is the Nasdaq running out of gas?

The daily chart below shows the Nasdaq Composite on top, and the percentage of stocks trading above the 40-day MA below. Note that the percentage of stocks trading above the 40ma is near a level that we normally associate with a significant pullback in the market, but the Nasdaq is at highs. That’s quite a bit of divergence.

During the last hour of trading on Tuesday, we sent out an intraday alert to cut back long exposure due to the lack of follow-through in recent breakouts. In Wednesday’s report, we went with tight stops to limit damage and even sold a few stocks ahead of the stop per intraday alert Wednesday morning. Through the years, we’ve found that sometimes it’s best to shoot first and ask questions later when open positions fail to move out as expected. We can always re-enter if/when market conditions improve and new setups emerge.

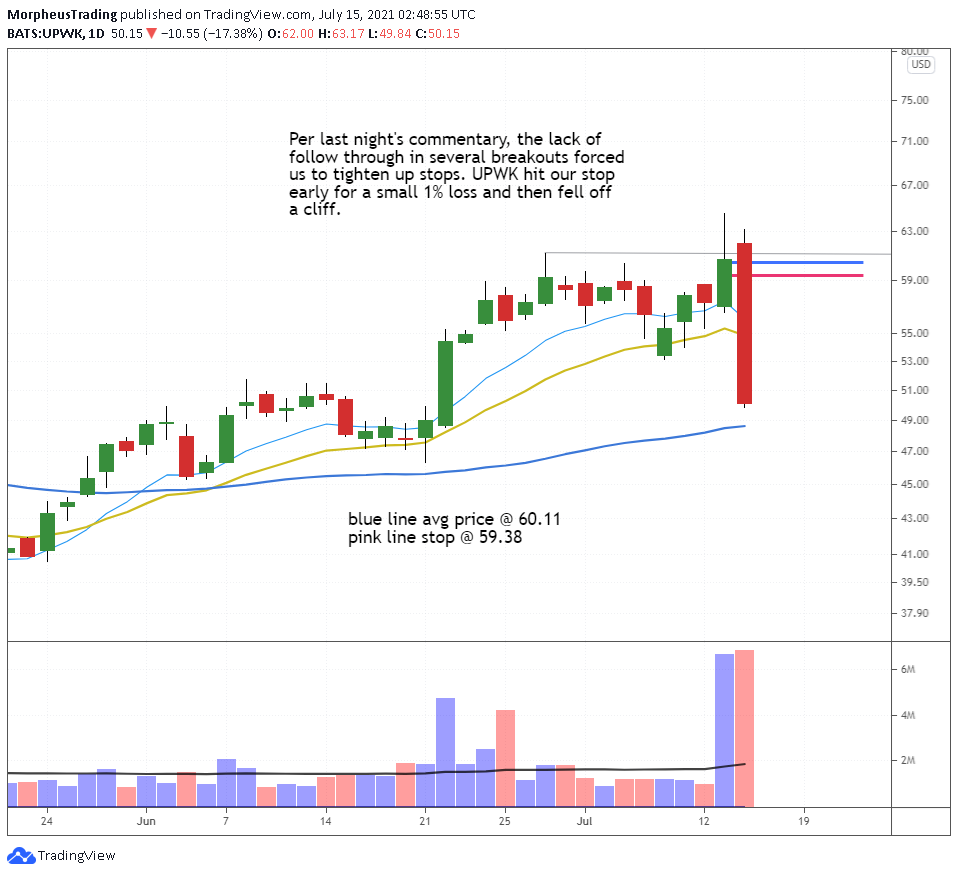

This was our thought process with $UPWK, which failed to follow through on Tuesday’s big volume breakout. Rather than sitting with a stop that is 5-7% below the average entry price, we moved the stop to just below break-even. $UPWK was a late breakout in a bad market for growth and was hammered on Wednesday. It’s definitely not a friendly environment for breakouts when we see this type of action.

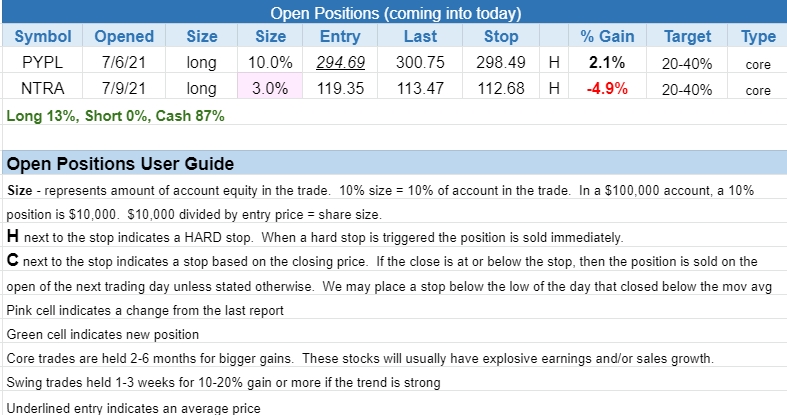

There are two open positions remaining in the model portfolio and both have a stop just beneath Wednesday’s low. Given the ugly price action in growth and $IWM, as well as the extended charts of $SPY and $QQQ, we are content to sit mostly in cash while we wait for new opportunities to emerge.

Unofficial Setups – For experienced traders only, no guidance is given for these setups.

Start my Wagner Daily membership now to start receiving winning Morpheus stock trade signals, including a stock portfolio you can easily follow. The Wagner Daily PRO includes live swing trader room for daily, real-time trade ideas and powerful stock trading education.